Key Benefits

Compliance in Days, not Months.

Get up and running in <48 hours with Taxbit’s drop-in Self-Certification SDK—no roadmap disruption, no heavy dev lift, no in-house tax expertise required

Full Automation. Zero Risk.

Automate the entire compliance workflow—from user onboarding to tax filing—and eliminate manual processes, gaps, and errors.

Future-Proof Compliance.

Taxbit’s expert-built, crypto-native platform keeps you ahead of CARF, DAC8, and global tax mandates–ensuring you’re always compliant and in control.

Plug-and-Play Self-Certification SDK

Seamlessly collect tax residency information during user onboarding—fully customizable, secure, and compliant.

Enterprise-Grade Security & Data Handling

Advanced encryption and tokenization safeguard user data in accordance with GDPR, SOC II, and global standards.

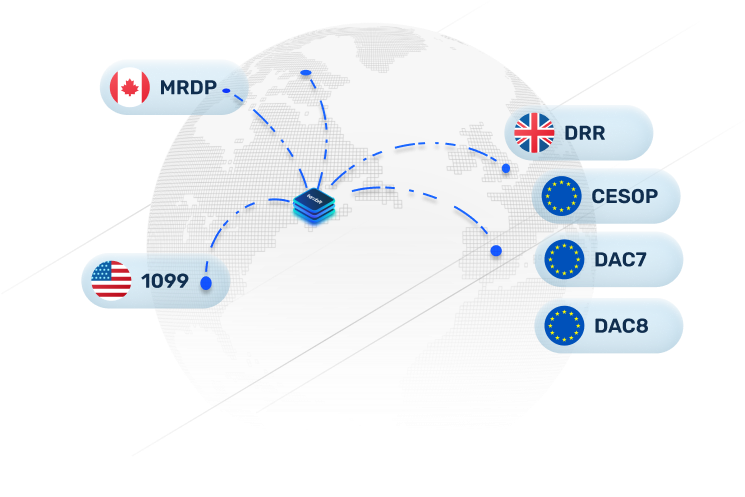

Automated Global Reporting

Generate and submit DAC8/CARF reports across jurisdictions via a single, integrated platform with real-time visibility and analytics.

How Taxbit Automates Your Tax Reporting

See how Taxbit streamlines the process from data ingestion to form generation, ensuring seamless compliance and accurate reporting for all your stakeholders.

Ingest Account Data from Various Sources

Seamlessly ingest account data from multiple sources, including self-certifications, W-9/W-8 forms, and general account information.

Taxbit consolidates your customer data into a single, unified system for efficient processing and compliance.

Automate Analysis, Calculations and Verifications

Automate the generation and verification of tax forms with precision. Taxbit handles complex calculations and ensures data accuracy at scale.

- US 1099s

- CESOP

- DAC7/MRDP

- DAC8/CARF

- Gain & Loss

Prep for Filing and Reporting

Effortlessly generate, file, and remediate tax reports across jurisdictions. Taxbit supports seamless submission while enabling compliance with global reporting standards, saving time and reducing manual effort.

.png)