Produced by Cryptocurrency Tax Attorneys and Blockchain CPAs

Overview

The UK government aims to develop high regulatory standards in the crypto industry that protect consumers and simultaneously allow innovation in the sector to thrive. True to this goal, His Majesty’s Revenue and Customs (HMRC) released the Cryptoassets Manual in March 2021. This manual represents one of the world’s most comprehensive guides to understanding the local tax implications that can arise from transactions involving cryptoassets.

This guide will help individuals understand the basic UK tax implications of some of the most common types of crypto transactions as outlined in the HMRC Cryptoassets Manual.

How does HMRC classify crypto?

The HMRC Cryptoassets Manual defines cryptoassets as “cryptographically secured digital representations of value or contractual rights that can be transferred, stored, [and/or] traded electronically.” This definition is broad enough to encompass both Non-Fungible Tokens (NFTs) as well as fungible cryptocurrencies such as Bitcoin.

HMRC does not consider cryptoassets to be currency or money. Rather, cryptoassets are classified as assets for tax purposes. The tax treatment of cryptoassets is dependent on the nature of the transaction involving the cryptoasset, not the definition of the token itself.

How is cryptocurrency taxed in the UK?

Income from cryptoassets must be included on your Form SA100 Tax Return. Cryptoassets will be subject to either Capital Gains Tax or Income Tax depending on the nature of the transaction:

Capital Gains Tax

Cryptoassets held for investment purposes will be subject to Capital Gains Tax when sold or otherwise disposed of. Capital Gains Tax treatment generally applies to any disposal, including:

- Selling crypto for fiat currency

- Trading one cryptocurrency for another

- Using tokens to pay for goods or services

- Gifting crypto to a person who is not a spouse or civil partner

The UK has an annual capital gains tax-free allowance, where only gains above this allowance are subject to tax. For tax year ending April 2023, the individual capital gains tax-free allowance is £12,300.

If your total capital gains (before considering any capital losses) for the year exceed the tax free allowance, you must report all your capital gains and losses on the Form SA108 Capital Gains Tax Summary. If you are in a capital loss position, you may still want to complete Form SA108 in order to register losses for future use as a tax loss carryforward (explained in more detail below).

Income Tax

Earned income paid to an individual in crypto will be taxed as income. Crypto transactions that result in taxable income include:

- Crypto received as payment for services, such as employment income

- Mining

- Staking

- Airdrops, but only where the airdrop is received in return for a service

Typically, the above items will be reported in Box 17 of your Form SA100 Tax Return.

Note on Crypto Trade or Business Activity

In rare circumstances, an individual may be so heavily involved in crypto activity on a day-to-day basis that the activity might be classified as practicing a financial trade/business. This classification would be based on the facts and circumstances of each case, but HMRC has stated that “only in exceptional circumstances would HMRC expect individuals to buy and sell exchange tokens with such frequency, level of organisation and sophistication that the activity amounts to a financial trade in itself.”

Where a financial trade or business does exist, the Income Tax rules take precedence over the Capital Gains Tax rules.

Are all crypto transactions taxable?

No, not every crypto transaction is taxable. The following activities aren’t considered taxable events:

- Buying cryptocurrency with fiat currency like pound sterling

- Transferring units of a particular cryptocurrency between wallets or accounts you control

- Gifting crypto to a spouse or civil partner

- Donating cryptocurrency to a charitable organization

What crypto transactions are taxable?

The following crypto activities are taxable events:

- Selling crypto for cash

- Trading one type of crypto for another

- Using crypto as payment

- Gifting crypto to a person who is not a spouse or civil partner

- Mining or staking crypto

- Receiving airdropped tokens

- Getting paid in crypto

When you sell, trade, or use crypto as a form of payment, you dispose of cryptocurrency; that disposal could result in a gain or loss depending on your cost basis in the units disposed of and the value of the cryptocurrency at the time of disposal. Regardless of whether you had a gain or loss, these transactions need to be reported on your tax return on Form SA108.

When you receive cryptocurrency from mining, staking, airdrops, or a payment for goods or services, you have income that needs to be reported on your tax return. The amount of income you report establishes your cost basis.

How do I determine my crypto capital gains or losses?

In simplest terms, when you dispose of a cryptoasset the gain or loss on the transaction is calculated using this formula:

Proceeds from the Sale – Cost Basis of the Asset Sold = Gain or (Loss)

In the UK, the cost basis of fungible cryptoassets is calculated using a method known as Share Pooling. Non-Fungible Tokens (NFTs) are non-fungible and so are not pooled.

What is Share Pooling?

Share Pooling in the UK refers to using the average cost of all assets purchased, with certain exceptions, to calculate the cost basis of assets upon disposition. There are three share pooling rules that should be applied in this order:

- The Same Day Rule – When the same type of token is acquired and disposed of on the same day, the cost basis of the disposal is matched with the acquired tokens.

- The 30-Day (Bed and Breakfast) Rule – When the same type of token is disposed of and subsequently re-acquired within 30 days, the cost basis of the disposal is matched with the re-acquired tokens using the earliest purchased tokens first.

- The Section 104 Pool – Tokens leftover after the above two rules are applied are added to that specific token’s “Section 104 Pool”. The cost basis of assets in the Section 104 Pool is calculated using the average cost method, where the allowable costs of all tokens in the pool is divided by the total number of tokens in the pool to determine the cost basis per asset.

The following two examples illustrate the above rules in action:

Example 1:

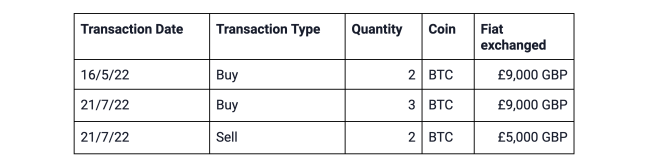

An individual has the following BTC transactions during 2022:

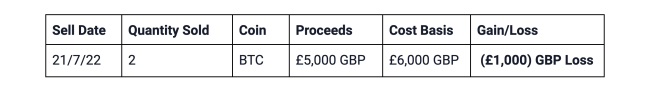

To calculate the gain or loss from the disposition on 21/7/22, the same day rule is applied. The disposition is first matched with the acquisition occurring on the same day. The cost basis of the 2 BTC disposed of is £6,000 GBP (£9,000 GBP / 3 BTC = £3,000 GBP per BTC X 2 BTC = £6,000 GBP Cost Basis), resulting in an overall loss of (£1,000) GBP.

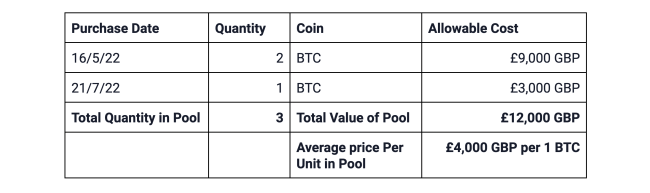

The 30 day rule does not apply as assets were not re-purchased within 30 days of a sale. The remaining 1 BTC acquired on 21/7/22, therefore, goes into the Section 104 Pool, along with the 2 BTC purchased on 16/5/22. The Section 104 Pool now contains the following:

Example 2:

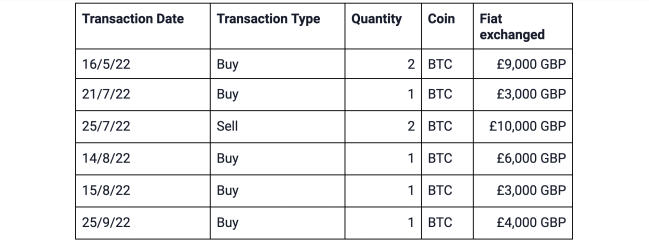

An individual has the following BTC transactions during 2022:

The Same-Day Rule does not apply in this example because there are no buys and sells occurring on the same day. We therefore move on to the 30-day Rule.

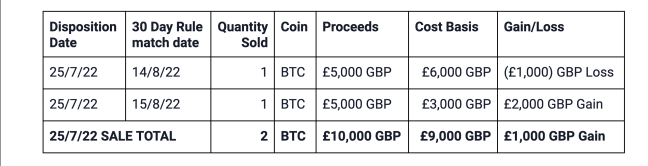

Because the individual repurchased BTC within 30 days of the 25/7/22 sale, the subsequently acquired tokens are matched with the previous sale using the earliest-purchased tokens first. This results in an overall gain of £1,000 GBP:

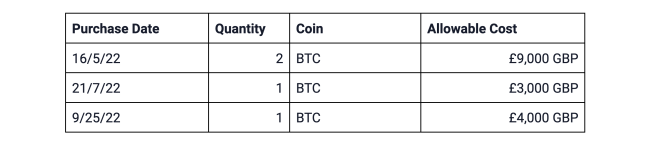

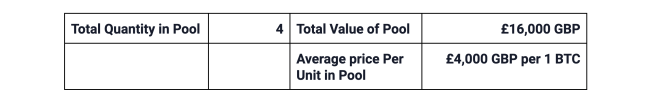

The remaining BTC that was not matched in the 30-day rule make up the Section 104 Pool:

What are Allowable Costs?

The HMRC Cryptoassets manual describes in detail what expenses are considered allowable costs that can be used to reduce cryptoasset capital gains and losses. Allowable costs include:

- The amount originally paid for the asset

- “Gas Fees,” or fees paid for having the transaction included on the distributed ledger

- Certain exchange fees paid on the purchase or disposition of the asset

- Professional costs to draw up a contract for the acquisition or disposal of the tokens

- Costs of making a valuation or apportionment to be able to calculate gains or losses

If one of the above fees is incurred in conjunction with the acquisition of cryptocurrency, it is considered an allowable cost that can be added to the appropriate pool based on the Share Pooling rules.

If one of the above fees is incurred in conjunction with the disposition of a cryptocurrency unit, this can be used to reduce the overall gain or loss resulting from the transaction.

Example of Allowable Costs when Purchasing Cryptocurrency

If you buy 1 BTC for £10,000 and pay £500 in fees that qualify as allowable costs, then the HMRC will allow you to add the full £10,500 to the appropriate share pool.

Adjusting for fees in this way increases the cost basis per unit in the pool and therefore allows a lesser realized taxable gain upon each sale from that pool.

Example of Allowable Costs when Selling Cryptocurrency

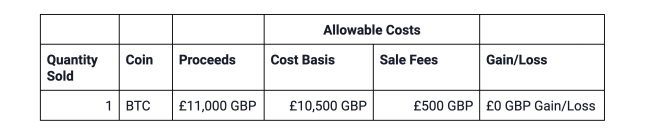

Assume the 1 BTC purchased in the above example is the only asset in the Section 104 Pool. You later sell 1 BTC for £11,000 and pay £500 in fees that qualify as allowable costs.

The HMRC will allow you to deduct the £500 fee as an allowable cost of sale, in addition to the cost basis of the asset being sold from the Section 104 Pool. In this case, the result would be no taxable gain:

If you didn’t account for the fees in this scenario, you’d have total allowable costs of £10,000 and proceeds of £11,000—resulting in a £1,000 taxable gain.

How do I calculate my gain/loss on gifted crypto?

In the UK, cryptoassets gifted to anyone other than a spouse or civil partner will result in a taxable disposition. The proceeds of the transaction are considered to be the pound sterling value of what has been given away at the time of the gift, and the cost basis is determined using the Share Pooling rules.

How can investors offset capital gains with capital losses?

The HMRC allows investors to offset capital gains with capital losses occurring within the same tax year. The difference between an individual’s capital gains and losses is called net capital gain or loss.

For example, if an individual had £30,000 in capital gains and (£8,000) in capital losses in the same tax year, the losses can offset capital gains, resulting in a net capital gain of £22,000. Net capital gains are only taxed to the extent that they exceed the tax free allowance. If the above happened during the 2022 tax year, total taxable gains would be:

£22,000 Net Capital Gain – £12,300 Tax Free Allowance = £9,700 Taxable Gain

Where capital losses exceed capital gains in a given tax year, you can only offset capital gains down to zero. The remaining net capital loss may be carried forward to offset net capital gains in future years as described in the next section.

What is a tax loss carry forward?

If you have a net capital loss, that loss can be carried forward to offset a net capital gain for the following tax year as long as the loss is registered with the HMRC. The easiest way to register your net capital loss is to include it on your Form SA108 Capital Gains Tax Summary in the tax year that the loss occurs.

For example, if you reported a net capital loss of (£5,000) on your Form SA108 for the tax year 1, this loss can be carried forward to offset any net capital gains for tax year 2.

If you also had a net capital loss in tax year 2, then the (£5,000) carryforward from year 1 could be used in tax year 3 along with any loss carryforward from tax year 2 that is registered with the HMRC.

How is mining/staking income treated?

As long as your income from mining or staking does not amount to a financial trade or business, the pound sterling value of the tokens at the time of receipt is reported as miscellaneous income on your Form SA100 Tax Return in Box 17.

The pound sterling value of the tokens on the date of receipt becomes the cost basis of the tokens and is added to the appropriate pool based on the share pooling rules described above.

How are airdrops treated?

The taxability of airdrops at the time of receipt depends on if you have done anything to earn the token. Even a small action taken to obtain an airdrop (“like my page to earn a token”) will pull the transaction into the earned category. For this reason, most airdropped tokens are considered earned.

Earned airdrops are taxable income at the time of receipt based on the pound sterling value of the tokens received. They will be reported as miscellaneous income on your Form SA100 Tax Return in Box 17. The taxable amount of the token becomes the cost basis for purposes of including the token in the appropriate pool based on the share pooling rules described above. As tokens are sold from the pool, they will be subject to Capital Gains Tax.

Unearned airdrops are not taxable income at the time of receipt. The cost basis of the unearned tokens is therefore zero. The token is still added to the appropriate pool based on the share pooling rules described above, and is subject to Capital Gains Tax as tokens are sold from the pool.

What is the tax rate for crypto?

Depending on the nature of the transaction, cryptocurrency is taxed at either the Income Tax Rate or the Capital Gains Tax Rate. The applicable rate depends on your UK Income Tax band.

| Income Tax Band | Taxable Income for 2023 | Income Tax Rate | Capital Gains Tax Rate |

|---|---|---|---|

| Personal Allowance | Up to £12,570 | 0% | 0% |

| Basic Rate | £12,571 to £50,270 | 20% | 10% |

| Higher Rate | £50,271 to £125,140 | 40% | 20% |

| Additional Rate | over £125,140 | 45% | 20% |

Cryptoasset transactions classified as Income (such as employment income, mining, certain airdrops, etc.) will be subject to tax at the Income Tax rate.

Cryptoasset transactions classified as Capital Gains (such as selling, trading, or otherwise disposing of tokens held for investment) will be subject to tax at the Capital Gains Tax rate.